All Categories

Featured

Table of Contents

Term life insurance policy is a type of policy that lasts a particular size of time, called the term. You select the length of the plan term when you first take out your life insurance policy. Maybe 5 years, twenty years or perhaps a lot more. If you die throughout the pre-selected term (and you've stayed on top of your costs), your insurance company will pay out a lump sum to your chosen beneficiaries.

Select your term and your quantity of cover. Select the plan that's right for you., you know your costs will remain the exact same throughout the term of the plan.

Level Term Life Insurance Rates

Life insurance policy covers most situations of fatality, however there will be some exclusions in the terms of the plan - Best level term life insurance.

After this, the policy ends and the making it through companion is no longer covered. Joint plans are normally much more budget-friendly than single life insurance policy plans.

This safeguards the getting power of your cover quantity against inflationLife cover is a terrific thing to have since it supplies financial security for your dependents if the worst takes place and you die. Your enjoyed ones can also use your life insurance payout to pay for your funeral. Whatever they pick to do, it's great assurance for you.

However, level term cover is wonderful for satisfying daily living expenditures such as household bills. You can likewise utilize your life insurance advantage to cover your interest-only home loan, settlement home loan, college costs or any kind of various other financial debts or ongoing repayments. On the various other hand, there are some drawbacks to level cover, contrasted to various other kinds of life plan.

What is the difference between Level Term Life Insurance Policy Options and other options?

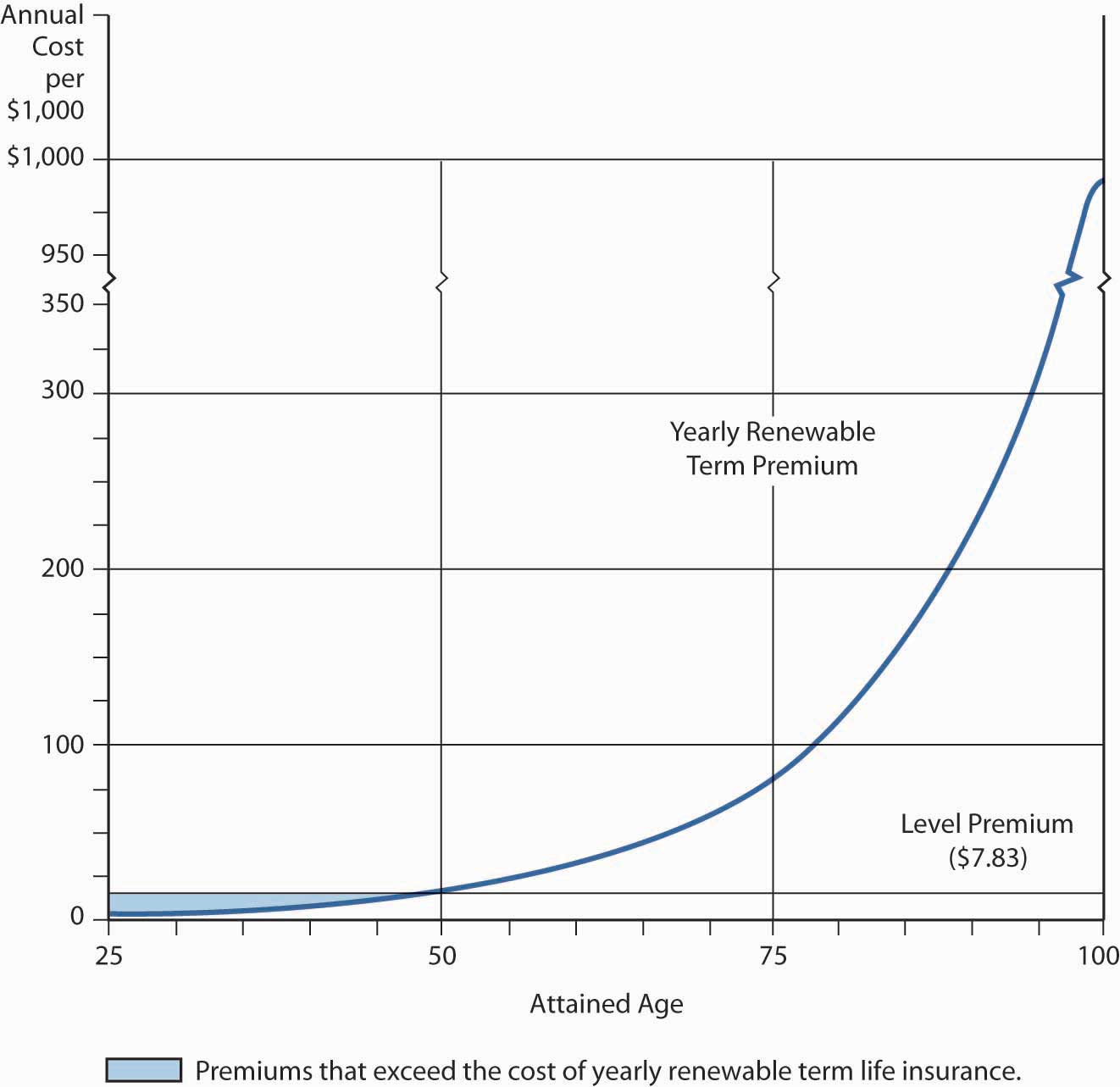

Words "degree" in the phrase "level term insurance" indicates that this sort of insurance policy has a set premium and face amount (survivor benefit) throughout the life of the policy. Merely placed, when individuals speak about term life insurance policy, they commonly refer to level term life insurance policy. For the majority of individuals, it is the simplest and most cost effective choice of all life insurance policy kinds.

The word "term" right here refers to an offered variety of years throughout which the level term life insurance stays active. Level term life insurance is just one of one of the most popular life insurance policy plans that life insurance carriers use to their customers because of its simplicity and price. It is likewise simple to compare level term life insurance policy quotes and get the very best costs.

The mechanism is as adheres to: To start with, pick a policy, death benefit amount and plan duration (or term size). Select to pay on either a monthly or yearly basis. If your premature demise takes place within the life of the policy, your life insurance provider will pay a round figure of fatality advantage to your predetermined beneficiaries.

What is the difference between Level Term Life Insurance For Families and other options?

Your degree term life insurance policy ends when you come to the end of your plan's term. Now, you have the following choices: Alternative A: Keep uninsured. This choice suits you when you can insure on your very own and when you have no financial debts or dependents. Alternative B: Purchase a new degree term life insurance policy policy.

FOR FINANCIAL PROFESSIONALS We have actually made to provide you with the most effective online experience. Your existing web browser could restrict that experience. You may be using an old web browser that's unsupported, or setups within your internet browser that are not suitable with our site. Please conserve on your own some frustration, and update your browser in order to view our site.

Can I get Compare Level Term Life Insurance online?

Currently making use of an updated internet browser and still having problem? Please provide us a telephone call at for more support. Your current browser: Identifying ...

If the policy expires prior to your fatality or you live past the plan term, there is no payout. You may be able to restore a term policy at expiry, but the costs will certainly be recalculated based on your age at the time of revival. Term life is generally the least pricey life insurance policy available since it uses a death advantage for a limited time and doesn't have a cash money worth component like permanent insurance policy has.

As you can see, the exact same 30-year-old healthy and balanced male would pay approximately $282 a month. At 50, he 'd pay $571. Whole Life Insurance Policy Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 long-term life insurance policy plan, for males and ladies in excellent health and wellness.

Who offers flexible Level Term Life Insurance Calculator plans?

That lowers the total danger to the insurer contrasted to a long-term life policy. The lowered risk is one variable that enables insurance firms to charge reduced costs. Rate of interest, the financials of the insurance policy firm, and state laws can additionally influence premiums. Generally, business frequently use much better prices at the "breakpoint" insurance coverage degrees of $100,000, $250,000, $500,000, and $1,000,000.

He purchases a 10-year, $500,000 term life insurance policy with a costs of $50 per month. If George passes away within the 10-year term, the policy will certainly pay George's recipient $500,000.

If he remains active and restores the policy after ten years, the costs will certainly be greater than his initial policy since they will certainly be based upon his current age of 40 instead of 30. Level term life insurance for seniors. If George is diagnosed with a terminal health problem during the very first policy term, he possibly will not be qualified to renew the policy when it ends

There are several types of term life insurance policy. The best option will certainly depend on your specific conditions. The majority of term life insurance policy has a level costs, and it's the kind we have actually been referring to in most of this article.

Who offers Level Term Life Insurance Vs Whole Life?

They might be a great choice for someone who needs temporary insurance policy. The policyholder pays a dealt with, degree costs for the period of the policy.

Latest Posts

Burial Life Insurance Policies

Life Insurance And Funeral Plan

Final Expense Contracts