All Categories

Featured

Table of Contents

- – What is the Role of Level Benefit Term Life In...

- – The Meaning of What Is A Level Term Life Insur...

- – How Does Term Life Insurance With Accidental ...

- – What is Increasing Term Life Insurance? A Sim...

- – What is What Is A Level Term Life Insurance ...

- – What is Simplified Term Life Insurance? How ...

- – What is the Purpose of Joint Term Life Insur...

With this type of level term insurance plan, you pay the very same regular monthly premium, and your recipient or beneficiaries would receive the exact same benefit in the occasion of your death, for the entire protection period of the policy. So how does life insurance policy operate in terms of expense? The cost of degree term life insurance policy will rely on your age and health and wellness as well as the term size and insurance coverage amount you pick.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Lady$1,000,00030$43.3135 Male$500,00020$20.7235 Woman$750,00020$23.1340 Man$600,00015$22.8440 Female$800,00015$27.72 Estimate based on rates for eligible Place Simple applicants in outstanding wellness. Regardless of what protection you choose, what the plan's cash value is, or what the lump amount of the fatality benefit transforms out to be, peace of mind is among the most valuable advantages associated with acquiring a life insurance plan.

Why would certainly somebody choose a plan with an annually sustainable premium? It might be an alternative to think about for someone that requires coverage only temporarily. As an example, an individual who is in between jobs yet desires survivor benefit protection in location because he or she has financial obligation or various other economic responsibilities may wish to consider an each year renewable policy or something to hold them over till they begin a new work that provides life insurance policy.

What is the Role of Level Benefit Term Life Insurance?

You can normally renew the plan annually which gives you time to consider your choices if you desire insurance coverage for longer. Realize that those options will certainly involve paying greater than you made use of to. As you get older, life insurance premiums end up being dramatically a lot more pricey. That's why it's useful to acquire the correct amount and size of protection when you initially get life insurance policy, so you can have a reduced rate while you're young and healthy.

If you add vital unsettled labor to the household, such as day care, ask yourself what it may cost to cover that caretaking job if you were no more there. After that, make certain you have that coverage in position to make sure that your family members gets the life insurance policy advantage that they need.

The Meaning of What Is A Level Term Life Insurance Policy

For that established amount of time, as long as you pay your costs, your price is steady and your recipients are shielded. Does that suggest you should always choose a 30-year term length? Not always. Generally, a shorter term plan has a reduced costs price than a much longer policy, so it's wise to pick a term based upon the predicted size of your economic obligations.

These are very important factors to bear in mind if you were considering choosing a long-term life insurance policy such as an entire life insurance plan. Numerous life insurance policy plans offer you the option to add life insurance coverage cyclists, think extra advantages, to your plan. Some life insurance policies come with bikers integrated to the cost of costs, or cyclists may be readily available at a price, or have actually costs when exercised.

How Does Term Life Insurance With Accidental Death Benefit Keep You Protected?

With term life insurance coverage, the communication that many people have with their life insurance policy business is a month-to-month expense for 10 to 30 years. You pay your month-to-month premiums and hope your household will never ever need to utilize it. For the group at Haven Life, that appeared like a missed opportunity.

We think navigating decisions regarding life insurance policy, your personal finances and overall health can be refreshingly easy (10-year level term life insurance). Our material is developed for instructional functions only. Sanctuary Life does not back the companies, items, solutions or strategies reviewed right here, however we wish they can make your life a little less difficult if they are a fit for your scenario

This product is not intended to provide, and must not be relied upon for tax, lawful, or investment guidance. Individuals are motivated to seed guidance from their very own tax or legal counsel. Read even more Haven Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in specific states, consisting of NC) provided by Massachusetts Mutual Life Insurance Policy Firm (MassMutual), Springfield, MA 01111-0001 and provided specifically with Sanctuary Life Insurance Coverage Firm, LLC.

Best Business as A++ (Superior; Top category of 15). The score is as of Aril 1, 2020 and goes through alter. MassMutual has gotten various scores from various other ranking agencies. Haven Life Plus (And Also) is the advertising name for the Plus rider, which is included as part of the Sanctuary Term policy and supplies accessibility to additional solutions and advantages at no charge or at a discount.

What is Increasing Term Life Insurance? A Simple Explanation?

Learn more in this overview. If you rely on somebody financially, you might ask yourself if they have a life insurance policy plan. Find out exactly how to find out.newsletter-msg-success,. newsletter-msg-error display: none;.

When you're younger, term life insurance policy can be an easy method to secure your loved ones. As life adjustments your economic concerns can as well, so you might desire to have entire life insurance coverage for its life time protection and added benefits that you can make use of while you're living.

What is What Is A Level Term Life Insurance Policy? Key Information for Policyholders

Approval is guaranteed despite your wellness. The premiums won't raise once they're set, yet they will go up with age, so it's an excellent concept to secure them in early. Locate out a lot more about how a term conversion functions.

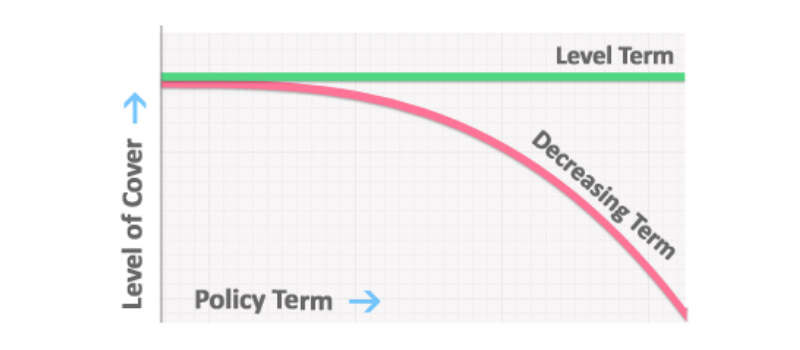

The word "level" in the phrase "level term insurance policy" means that this sort of insurance policy has a fixed costs and face amount (survivor benefit) throughout the life of the plan. Just put, when people discuss term life insurance coverage, they typically refer to level term life insurance policy. For the majority of people, it is the easiest and most budget friendly selection of all life insurance policy types.

What is Simplified Term Life Insurance? How It Works and Why It Matters?

The word "term" right here refers to a given variety of years during which the degree term life insurance coverage remains energetic. Level term life insurance policy is just one of the most preferred life insurance policy policies that life insurance policy companies use to their customers as a result of its simplicity and cost. It is likewise simple to contrast degree term life insurance policy quotes and get the most effective premiums.

The mechanism is as adheres to: Firstly, choose a plan, death benefit amount and plan period (or term length). Select to pay on either a month-to-month or annual basis. If your early demise happens within the life of the policy, your life insurer will pay a round figure of survivor benefit to your predetermined beneficiaries.

What is the Purpose of Joint Term Life Insurance?

Your degree term life insurance policy plan expires as soon as you come to the end of your policy's term. Now, you have the following choices: Alternative A: Remain without insurance. This alternative matches you when you can guarantee by yourself and when you have no financial debts or dependents. Choice B: Get a brand-new degree term life insurance policy.

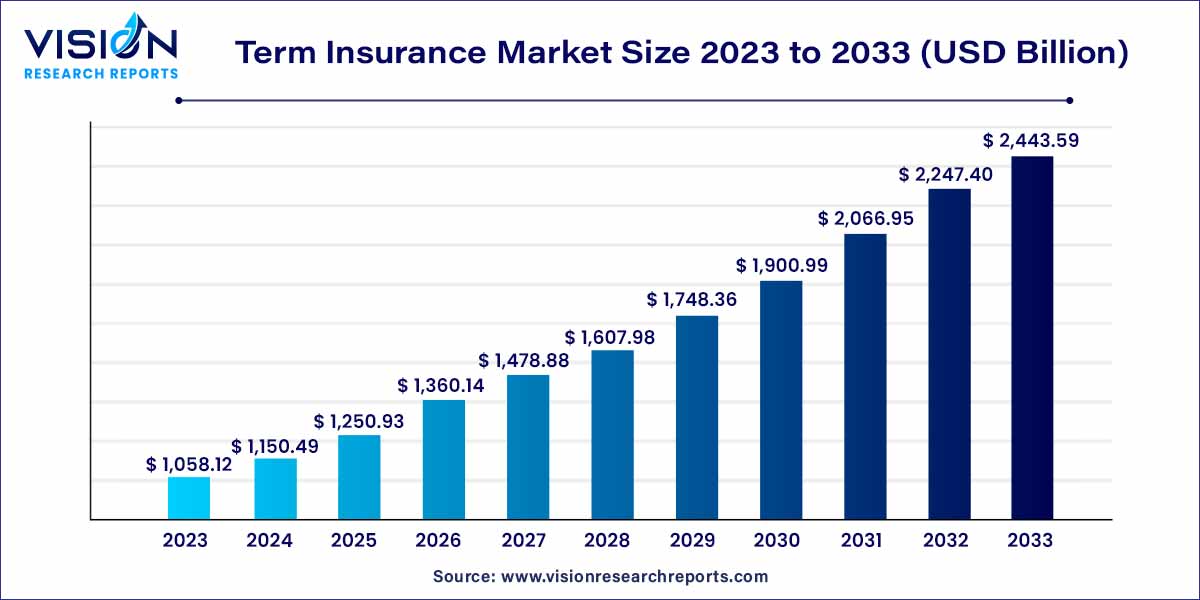

1 Life Insurance Policy Stats, Information And Industry Trends 2024. 2 Price of insurance policy rates are determined making use of methodologies that vary by business. These prices can vary and will normally boost with age. Rates for active workers may be various than those readily available to terminated or retired workers. It's essential to check out all variables when assessing the total competitiveness of prices and the value of life insurance policy protection.

Table of Contents

- – What is the Role of Level Benefit Term Life In...

- – The Meaning of What Is A Level Term Life Insur...

- – How Does Term Life Insurance With Accidental ...

- – What is Increasing Term Life Insurance? A Sim...

- – What is What Is A Level Term Life Insurance ...

- – What is Simplified Term Life Insurance? How ...

- – What is the Purpose of Joint Term Life Insur...

Latest Posts

Burial Life Insurance Policies

Life Insurance And Funeral Plan

Final Expense Contracts

More

Latest Posts

Burial Life Insurance Policies

Life Insurance And Funeral Plan

Final Expense Contracts